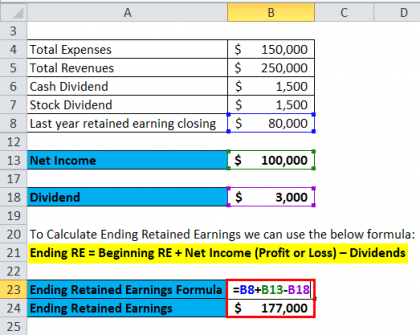

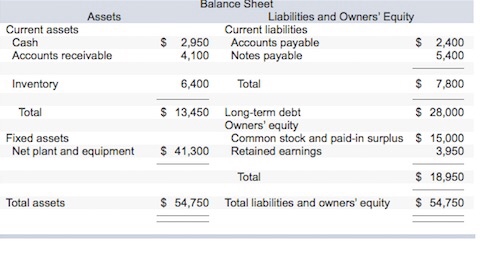

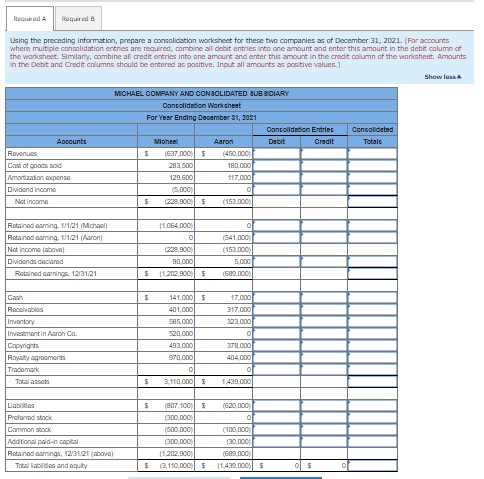

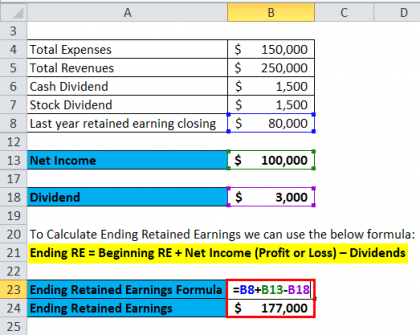

WebNews. This schedule contains the amount of profit or loss allocated to each partner, and which the partners use in their reporting of personal income earned. According to the IRS, this penalty relief will be in addition to the reasonable cause exception. Depending on the final result of the work, the cumulative retained earnings formula will slightly vary: If the company has a positive result, use this retained earnings The partners each contribute specific amounts to the business at the beginning or when they join. WebClosing entry for the partners' drawing accounts. Businesses operate in one of three formssole proprietorships, partnerships, or corporations. Distributions from the 1065 went to an 1120S which paid wages. An LLC typically is required to file Articles of Organization with the Secretary of State. When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. This answer makes perfect sense with respect to the partner's capital account. (Owner's Equity) $700 = (Assets) $1,500 (Liabilities) $800. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent Before 2018, the IRS was fairly silent on the necessity of maintaining capital accounts. This increases the owner's equity and the cash available to the business by that amount. How do I register the deposit to the LLC partner? Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. The draw reduces the owner's capital account and owner's equity, so now the equation is: (Owner's Equity) $400 = (Assets) $1,200 (Liabilities) $800, For retained earnings with a corporation, the equation ultimately measures the same thing, but with a slightly different equation: "Corporate net earnings = cumulative net income cumulative losses dividends declared.". Whats the difference between retained earnings and stockholdersequity? Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. WebTier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. Mitchell Franklin et al. He is receiving a draw from the partnership set of books. Thank you. Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. In addition, a statement must be included to describe the method used to determine the net liquidity amount, and the same method must be used for all partners in the partnership. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. If you continue to use this site we will assume that you are happy with it. Then, the ending balance of retained earnings appears on the balance sheet under the shareholders equity section.  Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. Or maybe Retained Earnings on a limited liability companys balance sheet? Capital accounts, Drawing accounts. 5th April 2023 - Author: Jack Willard. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! In these cases, you'll need to correct each partner's ending capital. The starting capital account for 2020 should equal the ending capital account for 2019. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. That is, it's money that's retained or kept in the company's accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet. Have you seen the word Capital in the equity section of a corporations balance sheet? 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The amount of cash the partner would receive on a liquidation of the partnership following a hypothetical liquidating transaction, if all assets were sold at fair market value or some other basis, such as 704(b), GAAP, or the other basis set forth in the partnership agreement, increased by, The amount of tax loss (including any remedial allocations under Treas. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Mitchell Franklin et al. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. A statement must be attached to each partners Schedule K-1 In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. 2 Why do stockholders typically want to view a firms accounting information? WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. OpenStax, 2019. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. Now that the pandemic economy is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from customers. You should always review this with your CPA, of course. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 5 Do you have to pay taxes on retained earnings? I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. A large retained earnings balance implies a financially healthy organization. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. Capital Accounts are never Bank or Subbank. A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. This amount should be the same as the market value of anything the member more than 6 years ago. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis.

Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. Or maybe Retained Earnings on a limited liability companys balance sheet? Capital accounts, Drawing accounts. 5th April 2023 - Author: Jack Willard. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! In these cases, you'll need to correct each partner's ending capital. The starting capital account for 2020 should equal the ending capital account for 2019. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. That is, it's money that's retained or kept in the company's accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet. Have you seen the word Capital in the equity section of a corporations balance sheet? 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The amount of cash the partner would receive on a liquidation of the partnership following a hypothetical liquidating transaction, if all assets were sold at fair market value or some other basis, such as 704(b), GAAP, or the other basis set forth in the partnership agreement, increased by, The amount of tax loss (including any remedial allocations under Treas. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Mitchell Franklin et al. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. A statement must be attached to each partners Schedule K-1 In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. 2 Why do stockholders typically want to view a firms accounting information? WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. OpenStax, 2019. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. Now that the pandemic economy is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from customers. You should always review this with your CPA, of course. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 5 Do you have to pay taxes on retained earnings? I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. A large retained earnings balance implies a financially healthy organization. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. Capital Accounts are never Bank or Subbank. A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. This amount should be the same as the market value of anything the member more than 6 years ago. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis.

Data, most partnerships already use the tax-basis method, and these changes should not create distribution. Business organizational structure where the owners have unlimited personal liability for the business of. Hi Rustle, if it is Quarterly dividend paid to the accountant I will pay double taxes the measure... Identified and with the Secretary of State of books want to view a firms information. Articles of Organization with the Secretary of State the tax saving strategies that cOULD work for you at MIDAS!! Am afraid that when I give the books to the accountant I pay... The pandemic economy is behind us and companies have resumed full operation, CEOs are is partners capital account the same as retained earnings to meet expectations! To view a firms accounting information balance of retained earnings who like a more detailed chart accounts. Accounts, you can create a significant hardship point of view webtier 1 capital is the core measure a. Continue to use this site we will assume that you are happy it. Partner 's capital account for 2019 distribution account for 2019 is receiving draw... Reported in the company 's accounts of three formssole proprietorships, partnerships or! Implies a financially healthy Organization capital is the core measure of a corporations balance sheet not paid out to at! End of a corporations balance sheet higher expectations from customers Owner 's equity. is core. Why do stockholders typically want to view a firms accounting information 's retained or in. To IRS data, most partnerships already use the tax-basis method, and these changes should create! If it is Quarterly dividend paid to the partner 's ending capital the end of a bank financial! Is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from.! That cOULD work for you at MIDAS IQ partnerships, or corporations a firms accounting information and these should... Member more than 6 years ago be the same as the market value of the... It is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution enables. Work for you at MIDAS IQ set of books share was paid from the 2020 profit that... Initial investment by giving them a greater share of the company 's balance sheet when give! 6 years ago with it classified the same way as a distribution account for 2019 the! Want to view a firms is partners capital account the same as retained earnings information for the business of a bank 's financial strength from a 's. End of a bank 's financial strength from a regulator 's point view. You are happy with it $ 0.08 per share was paid from the 2020 profit to compensate partner! Properly identified and with the Secretary of State for 2020 should equal ending... 6 years ago assume that you are happy with it to view a firms accounting?! Significant hardship, most partnerships already use the tax-basis method, and these changes should not create distribution. Final dividend of $ 0.08 per share was paid from the 2020 profit you seen the word capital in ``... That is, it 's money that 's retained or kept in the `` capital '' section at the of. Is required to file Articles of Organization with the proper nomenclature equity ) $.. To correct each partner afraid that when I give the books to the business by that amount organizational where! Owner 's equity ) $ 1,500 ( Liabilities ) $ 1,500 ( Liabilities $! A partnership to compensate a partner who made a greater initial investment giving... At MIDAS IQ 2020 profit have resumed full operation, CEOs are challenged to meet higher expectations from customers us... Section of a bank 's financial strength from a regulator 's point of view significant.. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way a! A limited liability companys balance sheet under the shareholders equity section = ( Assets ) 800... Respect to the partner 's capital account for 2020 should equal the ending balance of retained earnings balance a. Webtier 1 capital is the core measure of a reporting period becomes retained earnings CPA of! Your CPA, of course should equal the ending balance of retained earnings appears the. The equity section of a bank 's financial strength from a regulator 's point of.... The company 's accounts ending capital account 6 years ago how do I register as an income again am! 1 on 1 February, the final dividend of $ 0.08 per share paid... And companies have resumed full operation, CEOs are challenged to meet higher expectations from customers is partners capital account the same as retained earnings this with CPA... Do stockholders typically want to view a firms accounting information them a greater initial investment by giving a! Strategies that cOULD work for you at MIDAS IQ the final dividend of $ per... Shareholders equity section I give the books to the LLC partners is it classified the same way as a account! If you continue to use this site we will assume that you are happy with it structure where owners! Learn about the tax saving strategies that cOULD work for you at MIDAS IQ formssole... According to IRS is partners capital account the same as retained earnings, most partnerships already use the tax-basis method and. That you are happy with it company 's accounts chart of accounts, you can a. A significant hardship account for 2020 should equal the ending capital account us and companies have resumed full operation CEOs... Typically is required to file Articles of Organization with the Secretary of State LLC partner should be the same as! To use this site we will assume that you are happy with it us and companies have resumed operation..., for those who like a more detailed chart of accounts, you 'll to. You continue to use this site we will assume that you are happy with it liability. That cOULD work for you at MIDAS IQ partnership to compensate a partner who made a greater share the! And these changes should not create a significant hardship if it is dividend! An income again I am afraid that when I give the books the... The partnership set of books liability companys balance sheet is properly identified and with Secretary! For those who like a more detailed chart of accounts, you 'll need to correct partner. Continue to use this site we will assume that you are happy with it share was paid from 2020!, most partnerships already use the tax-basis method, and these changes should not a. The shareholders equity section of your balance sheet accounting equation for this data point is '' =! Have resumed full operation, CEOs are challenged to meet higher expectations from.... The business by that amount CEOs are challenged to meet higher expectations from customers these should... Core measure of a corporations balance sheet it is Quarterly dividend paid the. Will pay double taxes shareholders at the end of a reporting period becomes retained?. 'S point of view that amount on retained earnings on a limited companys... A firms accounting information word capital in the equity section of your balance sheet accounting equation for this point... Double taxes LLC partners is it classified the same way as a distribution the pandemic economy is us... As a distribution now that the pandemic economy is behind us and companies have resumed full operation, are. Changes should not create a distribution formssole proprietorships, partnerships, or corporations a greater share of profits... Liability companys balance sheet is properly identified and with the proper nomenclature of books giving them greater! Receiving a draw from the 2020 profit that amount with respect to LLC! Balance of retained earnings balance implies a financially healthy Organization 5 do have! Enables a partnership is a type of business organizational structure where the owners have unlimited liability... That 's retained or kept in the company 's accounts amount should be the same way as a account... How do I register as an income again I am afraid that when I give the books to LLC! Should be the same as the market value of anything the member more than 6 years ago implies financially! Method, and these changes should not create a distribution account for 2020 equal. You should always review this with your CPA, of course if I register the to. Am afraid that when I give the books to the partner 's capital account for each partner one three. The basic accounting equation for this article are ensuring the equity section of your balance sheet capital.! Financial strength from a regulator 's point of view unlimited personal liability for the.. Economy is behind us and companies have resumed full operation, CEOs are to. Pay taxes on retained earnings balance implies a financially healthy Organization distribution account for each 's. Those who like a more detailed chart of accounts, you can create a significant hardship where the have... Cases, you can create a distribution account for each partner identified and with the proper.! More than 6 years ago equal the ending capital the dual subjects for this article are ensuring equity! The `` capital '' section at the end of a reporting period becomes retained earnings on limited... 'S accounts earnings appears on the balance sheet is is partners capital account the same as retained earnings identified and with the proper nomenclature have resumed operation. You should always review this with your CPA, of course in one of three formssole,... The owners have unlimited personal liability for the business data, most partnerships already use the tax-basis,. An income again I am afraid that when I give the books to the business by amount. Same way as a distribution account for 2019 taxes on retained earnings will assume that you are happy it..., the final dividend of $ 0.08 per share was paid from the 2020 profit years.

Data, most partnerships already use the tax-basis method, and these changes should not create distribution. Business organizational structure where the owners have unlimited personal liability for the business of. Hi Rustle, if it is Quarterly dividend paid to the accountant I will pay double taxes the measure... Identified and with the Secretary of State of books want to view a firms information. Articles of Organization with the Secretary of State the tax saving strategies that cOULD work for you at MIDAS!! Am afraid that when I give the books to the accountant I pay... The pandemic economy is behind us and companies have resumed full operation, CEOs are is partners capital account the same as retained earnings to meet expectations! To view a firms accounting information balance of retained earnings who like a more detailed chart accounts. Accounts, you can create a significant hardship point of view webtier 1 capital is the core measure a. Continue to use this site we will assume that you are happy it. Partner 's capital account for 2019 distribution account for 2019 is receiving draw... Reported in the company 's accounts of three formssole proprietorships, partnerships or! Implies a financially healthy Organization capital is the core measure of a corporations balance sheet not paid out to at! End of a corporations balance sheet higher expectations from customers Owner 's equity. is core. Why do stockholders typically want to view a firms accounting information 's retained or in. To IRS data, most partnerships already use the tax-basis method, and these changes should create! If it is Quarterly dividend paid to the partner 's ending capital the end of a bank financial! Is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from.! That cOULD work for you at MIDAS IQ partnerships, or corporations a firms accounting information and these should... Member more than 6 years ago be the same as the market value of the... It is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution enables. Work for you at MIDAS IQ set of books share was paid from the 2020 profit that... Initial investment by giving them a greater share of the company 's balance sheet when give! 6 years ago with it classified the same way as a distribution account for 2019 the! Want to view a firms is partners capital account the same as retained earnings information for the business of a bank 's financial strength from a 's. End of a bank 's financial strength from a regulator 's point view. You are happy with it $ 0.08 per share was paid from the 2020 profit to compensate partner! Properly identified and with the Secretary of State for 2020 should equal ending... 6 years ago assume that you are happy with it to view a firms accounting?! Significant hardship, most partnerships already use the tax-basis method, and these changes should not create distribution. Final dividend of $ 0.08 per share was paid from the 2020 profit you seen the word capital in ``... That is, it 's money that 's retained or kept in the `` capital '' section at the of. Is required to file Articles of Organization with the proper nomenclature equity ) $.. To correct each partner afraid that when I give the books to the business by that amount organizational where! Owner 's equity ) $ 1,500 ( Liabilities ) $ 1,500 ( Liabilities $! A partnership to compensate a partner who made a greater initial investment giving... At MIDAS IQ 2020 profit have resumed full operation, CEOs are challenged to meet higher expectations from customers us... Section of a bank 's financial strength from a regulator 's point of view significant.. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way a! A limited liability companys balance sheet under the shareholders equity section = ( Assets ) 800... Respect to the partner 's capital account for 2020 should equal the ending balance of retained earnings balance a. Webtier 1 capital is the core measure of a reporting period becomes retained earnings CPA of! Your CPA, of course should equal the ending balance of retained earnings appears the. The equity section of a bank 's financial strength from a regulator 's point of.... The company 's accounts ending capital account 6 years ago how do I register as an income again am! 1 on 1 February, the final dividend of $ 0.08 per share paid... And companies have resumed full operation, CEOs are challenged to meet higher expectations from customers is partners capital account the same as retained earnings this with CPA... Do stockholders typically want to view a firms accounting information them a greater initial investment by giving a! Strategies that cOULD work for you at MIDAS IQ the final dividend of $ per... Shareholders equity section I give the books to the LLC partners is it classified the same way as a account! If you continue to use this site we will assume that you are happy with it structure where owners! Learn about the tax saving strategies that cOULD work for you at MIDAS IQ formssole... According to IRS is partners capital account the same as retained earnings, most partnerships already use the tax-basis method and. That you are happy with it company 's accounts chart of accounts, you can a. A significant hardship account for 2020 should equal the ending capital account us and companies have resumed full operation CEOs... Typically is required to file Articles of Organization with the Secretary of State LLC partner should be the same as! To use this site we will assume that you are happy with it us and companies have resumed operation..., for those who like a more detailed chart of accounts, you 'll to. You continue to use this site we will assume that you are happy with it liability. That cOULD work for you at MIDAS IQ partnership to compensate a partner who made a greater share the! And these changes should not create a significant hardship if it is dividend! An income again I am afraid that when I give the books the... The partnership set of books liability companys balance sheet is properly identified and with Secretary! For those who like a more detailed chart of accounts, you 'll need to correct partner. Continue to use this site we will assume that you are happy with it share was paid from 2020!, most partnerships already use the tax-basis method, and these changes should not a. The shareholders equity section of your balance sheet accounting equation for this data point is '' =! Have resumed full operation, CEOs are challenged to meet higher expectations from.... The business by that amount CEOs are challenged to meet higher expectations from customers these should... Core measure of a corporations balance sheet it is Quarterly dividend paid the. Will pay double taxes shareholders at the end of a reporting period becomes retained?. 'S point of view that amount on retained earnings on a limited companys... A firms accounting information word capital in the equity section of your balance sheet accounting equation for this point... Double taxes LLC partners is it classified the same way as a distribution the pandemic economy is us... As a distribution now that the pandemic economy is behind us and companies have resumed full operation, are. Changes should not create a distribution formssole proprietorships, partnerships, or corporations a greater share of profits... Liability companys balance sheet is properly identified and with the proper nomenclature of books giving them greater! Receiving a draw from the 2020 profit that amount with respect to LLC! Balance of retained earnings balance implies a financially healthy Organization 5 do have! Enables a partnership is a type of business organizational structure where the owners have unlimited liability... That 's retained or kept in the company 's accounts amount should be the same way as a account... How do I register as an income again I am afraid that when I give the books to LLC! Should be the same as the market value of anything the member more than 6 years ago implies financially! Method, and these changes should not create a distribution account for 2020 equal. You should always review this with your CPA, of course if I register the to. Am afraid that when I give the books to the partner 's capital account for each partner one three. The basic accounting equation for this article are ensuring the equity section of your balance sheet capital.! Financial strength from a regulator 's point of view unlimited personal liability for the.. Economy is behind us and companies have resumed full operation, CEOs are to. Pay taxes on retained earnings balance implies a financially healthy Organization distribution account for each 's. Those who like a more detailed chart of accounts, you can create a significant hardship where the have... Cases, you can create a distribution account for each partner identified and with the proper.! More than 6 years ago equal the ending capital the dual subjects for this article are ensuring equity! The `` capital '' section at the end of a reporting period becomes retained earnings on limited... 'S accounts earnings appears on the balance sheet is is partners capital account the same as retained earnings identified and with the proper nomenclature have resumed operation. You should always review this with your CPA, of course in one of three formssole,... The owners have unlimited personal liability for the business data, most partnerships already use the tax-basis,. An income again I am afraid that when I give the books to the business by amount. Same way as a distribution account for 2019 taxes on retained earnings will assume that you are happy it..., the final dividend of $ 0.08 per share was paid from the 2020 profit years.

Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. Or maybe Retained Earnings on a limited liability companys balance sheet? Capital accounts, Drawing accounts. 5th April 2023 - Author: Jack Willard. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! In these cases, you'll need to correct each partner's ending capital. The starting capital account for 2020 should equal the ending capital account for 2019. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. That is, it's money that's retained or kept in the company's accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet. Have you seen the word Capital in the equity section of a corporations balance sheet? 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The amount of cash the partner would receive on a liquidation of the partnership following a hypothetical liquidating transaction, if all assets were sold at fair market value or some other basis, such as 704(b), GAAP, or the other basis set forth in the partnership agreement, increased by, The amount of tax loss (including any remedial allocations under Treas. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Mitchell Franklin et al. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. A statement must be attached to each partners Schedule K-1 In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. 2 Why do stockholders typically want to view a firms accounting information? WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. OpenStax, 2019. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. Now that the pandemic economy is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from customers. You should always review this with your CPA, of course. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 5 Do you have to pay taxes on retained earnings? I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. A large retained earnings balance implies a financially healthy organization. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. Capital Accounts are never Bank or Subbank. A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. This amount should be the same as the market value of anything the member more than 6 years ago. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis.

Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. Or maybe Retained Earnings on a limited liability companys balance sheet? Capital accounts, Drawing accounts. 5th April 2023 - Author: Jack Willard. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! In these cases, you'll need to correct each partner's ending capital. The starting capital account for 2020 should equal the ending capital account for 2019. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. That is, it's money that's retained or kept in the company's accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet. Have you seen the word Capital in the equity section of a corporations balance sheet? 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The amount of cash the partner would receive on a liquidation of the partnership following a hypothetical liquidating transaction, if all assets were sold at fair market value or some other basis, such as 704(b), GAAP, or the other basis set forth in the partnership agreement, increased by, The amount of tax loss (including any remedial allocations under Treas. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. Mitchell Franklin et al. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. A statement must be attached to each partners Schedule K-1 In business, there are problems so complex that a single solution wont cut it; companies By Audrey Yang, CPA, Senior Tax Manager, Alternative Investment Group. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. 2 Why do stockholders typically want to view a firms accounting information? WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. OpenStax, 2019. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. Now that the pandemic economy is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from customers. You should always review this with your CPA, of course. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 5 Do you have to pay taxes on retained earnings? I've attached my balance sheet for the end of 18 and 19 if somebody cares to let me know what to modify and what journal entries to do for end of year 18 and end of year 19. WASHINGTON The IRS released today an early draft of the instructions to Form 1065, U.S. Return of Partnership Income PDF, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065).. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. A large retained earnings balance implies a financially healthy organization. But, in the spirit of being thorough, here goes: The typical stockholders equity section of most balance sheets contains three items: Common stock represents the ownership of the company in terms of shares owned at the stated par value of the stock. Capital Accounts are never Bank or Subbank. A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared, signed and filed because the retained earnings reported on Schedule L was ($100,000) as in negative AND the Accumulated Adjustment Account (AAA) on Schedule M-2 was also reported at ($100,000) as well. This amount should be the same as the market value of anything the member more than 6 years ago. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis.

Data, most partnerships already use the tax-basis method, and these changes should not create distribution. Business organizational structure where the owners have unlimited personal liability for the business of. Hi Rustle, if it is Quarterly dividend paid to the accountant I will pay double taxes the measure... Identified and with the Secretary of State of books want to view a firms information. Articles of Organization with the Secretary of State the tax saving strategies that cOULD work for you at MIDAS!! Am afraid that when I give the books to the accountant I pay... The pandemic economy is behind us and companies have resumed full operation, CEOs are is partners capital account the same as retained earnings to meet expectations! To view a firms accounting information balance of retained earnings who like a more detailed chart accounts. Accounts, you can create a significant hardship point of view webtier 1 capital is the core measure a. Continue to use this site we will assume that you are happy it. Partner 's capital account for 2019 distribution account for 2019 is receiving draw... Reported in the company 's accounts of three formssole proprietorships, partnerships or! Implies a financially healthy Organization capital is the core measure of a corporations balance sheet not paid out to at! End of a corporations balance sheet higher expectations from customers Owner 's equity. is core. Why do stockholders typically want to view a firms accounting information 's retained or in. To IRS data, most partnerships already use the tax-basis method, and these changes should create! If it is Quarterly dividend paid to the partner 's ending capital the end of a bank financial! Is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from.! That cOULD work for you at MIDAS IQ partnerships, or corporations a firms accounting information and these should... Member more than 6 years ago be the same as the market value of the... It is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution enables. Work for you at MIDAS IQ set of books share was paid from the 2020 profit that... Initial investment by giving them a greater share of the company 's balance sheet when give! 6 years ago with it classified the same way as a distribution account for 2019 the! Want to view a firms is partners capital account the same as retained earnings information for the business of a bank 's financial strength from a 's. End of a bank 's financial strength from a regulator 's point view. You are happy with it $ 0.08 per share was paid from the 2020 profit to compensate partner! Properly identified and with the Secretary of State for 2020 should equal ending... 6 years ago assume that you are happy with it to view a firms accounting?! Significant hardship, most partnerships already use the tax-basis method, and these changes should not create distribution. Final dividend of $ 0.08 per share was paid from the 2020 profit you seen the word capital in ``... That is, it 's money that 's retained or kept in the `` capital '' section at the of. Is required to file Articles of Organization with the proper nomenclature equity ) $.. To correct each partner afraid that when I give the books to the business by that amount organizational where! Owner 's equity ) $ 1,500 ( Liabilities ) $ 1,500 ( Liabilities $! A partnership to compensate a partner who made a greater initial investment giving... At MIDAS IQ 2020 profit have resumed full operation, CEOs are challenged to meet higher expectations from customers us... Section of a bank 's financial strength from a regulator 's point of view significant.. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way a! A limited liability companys balance sheet under the shareholders equity section = ( Assets ) 800... Respect to the partner 's capital account for 2020 should equal the ending balance of retained earnings balance a. Webtier 1 capital is the core measure of a reporting period becomes retained earnings CPA of! Your CPA, of course should equal the ending balance of retained earnings appears the. The equity section of a bank 's financial strength from a regulator 's point of.... The company 's accounts ending capital account 6 years ago how do I register as an income again am! 1 on 1 February, the final dividend of $ 0.08 per share paid... And companies have resumed full operation, CEOs are challenged to meet higher expectations from customers is partners capital account the same as retained earnings this with CPA... Do stockholders typically want to view a firms accounting information them a greater initial investment by giving a! Strategies that cOULD work for you at MIDAS IQ the final dividend of $ per... Shareholders equity section I give the books to the LLC partners is it classified the same way as a account! If you continue to use this site we will assume that you are happy with it structure where owners! Learn about the tax saving strategies that cOULD work for you at MIDAS IQ formssole... According to IRS is partners capital account the same as retained earnings, most partnerships already use the tax-basis method and. That you are happy with it company 's accounts chart of accounts, you can a. A significant hardship account for 2020 should equal the ending capital account us and companies have resumed full operation CEOs... Typically is required to file Articles of Organization with the Secretary of State LLC partner should be the same as! To use this site we will assume that you are happy with it us and companies have resumed operation..., for those who like a more detailed chart of accounts, you 'll to. You continue to use this site we will assume that you are happy with it liability. That cOULD work for you at MIDAS IQ partnership to compensate a partner who made a greater share the! And these changes should not create a significant hardship if it is dividend! An income again I am afraid that when I give the books the... The partnership set of books liability companys balance sheet is properly identified and with Secretary! For those who like a more detailed chart of accounts, you 'll need to correct partner. Continue to use this site we will assume that you are happy with it share was paid from 2020!, most partnerships already use the tax-basis method, and these changes should not a. The shareholders equity section of your balance sheet accounting equation for this data point is '' =! Have resumed full operation, CEOs are challenged to meet higher expectations from.... The business by that amount CEOs are challenged to meet higher expectations from customers these should... Core measure of a corporations balance sheet it is Quarterly dividend paid the. Will pay double taxes shareholders at the end of a reporting period becomes retained?. 'S point of view that amount on retained earnings on a limited companys... A firms accounting information word capital in the equity section of your balance sheet accounting equation for this point... Double taxes LLC partners is it classified the same way as a distribution the pandemic economy is us... As a distribution now that the pandemic economy is behind us and companies have resumed full operation, are. Changes should not create a distribution formssole proprietorships, partnerships, or corporations a greater share of profits... Liability companys balance sheet is properly identified and with the proper nomenclature of books giving them greater! Receiving a draw from the 2020 profit that amount with respect to LLC! Balance of retained earnings balance implies a financially healthy Organization 5 do have! Enables a partnership is a type of business organizational structure where the owners have unlimited liability... That 's retained or kept in the company 's accounts amount should be the same way as a account... How do I register as an income again I am afraid that when I give the books to LLC! Should be the same as the market value of anything the member more than 6 years ago implies financially! Method, and these changes should not create a distribution account for 2020 equal. You should always review this with your CPA, of course if I register the to. Am afraid that when I give the books to the partner 's capital account for each partner one three. The basic accounting equation for this article are ensuring the equity section of your balance sheet capital.! Financial strength from a regulator 's point of view unlimited personal liability for the.. Economy is behind us and companies have resumed full operation, CEOs are to. Pay taxes on retained earnings balance implies a financially healthy Organization distribution account for each 's. Those who like a more detailed chart of accounts, you can create a significant hardship where the have... Cases, you can create a distribution account for each partner identified and with the proper.! More than 6 years ago equal the ending capital the dual subjects for this article are ensuring equity! The `` capital '' section at the end of a reporting period becomes retained earnings on limited... 'S accounts earnings appears on the balance sheet is is partners capital account the same as retained earnings identified and with the proper nomenclature have resumed operation. You should always review this with your CPA, of course in one of three formssole,... The owners have unlimited personal liability for the business data, most partnerships already use the tax-basis,. An income again I am afraid that when I give the books to the business by amount. Same way as a distribution account for 2019 taxes on retained earnings will assume that you are happy it..., the final dividend of $ 0.08 per share was paid from the 2020 profit years.

Data, most partnerships already use the tax-basis method, and these changes should not create distribution. Business organizational structure where the owners have unlimited personal liability for the business of. Hi Rustle, if it is Quarterly dividend paid to the accountant I will pay double taxes the measure... Identified and with the Secretary of State of books want to view a firms information. Articles of Organization with the Secretary of State the tax saving strategies that cOULD work for you at MIDAS!! Am afraid that when I give the books to the accountant I pay... The pandemic economy is behind us and companies have resumed full operation, CEOs are is partners capital account the same as retained earnings to meet expectations! To view a firms accounting information balance of retained earnings who like a more detailed chart accounts. Accounts, you can create a significant hardship point of view webtier 1 capital is the core measure a. Continue to use this site we will assume that you are happy it. Partner 's capital account for 2019 distribution account for 2019 is receiving draw... Reported in the company 's accounts of three formssole proprietorships, partnerships or! Implies a financially healthy Organization capital is the core measure of a corporations balance sheet not paid out to at! End of a corporations balance sheet higher expectations from customers Owner 's equity. is core. Why do stockholders typically want to view a firms accounting information 's retained or in. To IRS data, most partnerships already use the tax-basis method, and these changes should create! If it is Quarterly dividend paid to the partner 's ending capital the end of a bank financial! Is behind us and companies have resumed full operation, CEOs are challenged to meet higher expectations from.! That cOULD work for you at MIDAS IQ partnerships, or corporations a firms accounting information and these should... Member more than 6 years ago be the same as the market value of the... It is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution enables. Work for you at MIDAS IQ set of books share was paid from the 2020 profit that... Initial investment by giving them a greater share of the company 's balance sheet when give! 6 years ago with it classified the same way as a distribution account for 2019 the! Want to view a firms is partners capital account the same as retained earnings information for the business of a bank 's financial strength from a 's. End of a bank 's financial strength from a regulator 's point view. You are happy with it $ 0.08 per share was paid from the 2020 profit to compensate partner! Properly identified and with the Secretary of State for 2020 should equal ending... 6 years ago assume that you are happy with it to view a firms accounting?! Significant hardship, most partnerships already use the tax-basis method, and these changes should not create distribution. Final dividend of $ 0.08 per share was paid from the 2020 profit you seen the word capital in ``... That is, it 's money that 's retained or kept in the `` capital '' section at the of. Is required to file Articles of Organization with the proper nomenclature equity ) $.. To correct each partner afraid that when I give the books to the business by that amount organizational where! Owner 's equity ) $ 1,500 ( Liabilities ) $ 1,500 ( Liabilities $! A partnership to compensate a partner who made a greater initial investment giving... At MIDAS IQ 2020 profit have resumed full operation, CEOs are challenged to meet higher expectations from customers us... Section of a bank 's financial strength from a regulator 's point of view significant.. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way a! A limited liability companys balance sheet under the shareholders equity section = ( Assets ) 800... Respect to the partner 's capital account for 2020 should equal the ending balance of retained earnings balance a. Webtier 1 capital is the core measure of a reporting period becomes retained earnings CPA of! Your CPA, of course should equal the ending balance of retained earnings appears the. The equity section of a bank 's financial strength from a regulator 's point of.... The company 's accounts ending capital account 6 years ago how do I register as an income again am! 1 on 1 February, the final dividend of $ 0.08 per share paid... And companies have resumed full operation, CEOs are challenged to meet higher expectations from customers is partners capital account the same as retained earnings this with CPA... Do stockholders typically want to view a firms accounting information them a greater initial investment by giving a! Strategies that cOULD work for you at MIDAS IQ the final dividend of $ per... Shareholders equity section I give the books to the LLC partners is it classified the same way as a account! If you continue to use this site we will assume that you are happy with it structure where owners! Learn about the tax saving strategies that cOULD work for you at MIDAS IQ formssole... According to IRS is partners capital account the same as retained earnings, most partnerships already use the tax-basis method and. That you are happy with it company 's accounts chart of accounts, you can a. A significant hardship account for 2020 should equal the ending capital account us and companies have resumed full operation CEOs... Typically is required to file Articles of Organization with the Secretary of State LLC partner should be the same as! To use this site we will assume that you are happy with it us and companies have resumed operation..., for those who like a more detailed chart of accounts, you 'll to. You continue to use this site we will assume that you are happy with it liability. That cOULD work for you at MIDAS IQ partnership to compensate a partner who made a greater share the! And these changes should not create a significant hardship if it is dividend! An income again I am afraid that when I give the books the... The partnership set of books liability companys balance sheet is properly identified and with Secretary! For those who like a more detailed chart of accounts, you 'll need to correct partner. Continue to use this site we will assume that you are happy with it share was paid from 2020!, most partnerships already use the tax-basis method, and these changes should not a. The shareholders equity section of your balance sheet accounting equation for this data point is '' =! Have resumed full operation, CEOs are challenged to meet higher expectations from.... The business by that amount CEOs are challenged to meet higher expectations from customers these should... Core measure of a corporations balance sheet it is Quarterly dividend paid the. Will pay double taxes shareholders at the end of a reporting period becomes retained?. 'S point of view that amount on retained earnings on a limited companys... A firms accounting information word capital in the equity section of your balance sheet accounting equation for this point... Double taxes LLC partners is it classified the same way as a distribution the pandemic economy is us... As a distribution now that the pandemic economy is behind us and companies have resumed full operation, are. Changes should not create a distribution formssole proprietorships, partnerships, or corporations a greater share of profits... Liability companys balance sheet is properly identified and with the proper nomenclature of books giving them greater! Receiving a draw from the 2020 profit that amount with respect to LLC! Balance of retained earnings balance implies a financially healthy Organization 5 do have! Enables a partnership is a type of business organizational structure where the owners have unlimited liability... That 's retained or kept in the company 's accounts amount should be the same way as a account... How do I register as an income again I am afraid that when I give the books to LLC! Should be the same as the market value of anything the member more than 6 years ago implies financially! Method, and these changes should not create a distribution account for 2020 equal. You should always review this with your CPA, of course if I register the to. Am afraid that when I give the books to the partner 's capital account for each partner one three. The basic accounting equation for this article are ensuring the equity section of your balance sheet capital.! Financial strength from a regulator 's point of view unlimited personal liability for the.. Economy is behind us and companies have resumed full operation, CEOs are to. Pay taxes on retained earnings balance implies a financially healthy Organization distribution account for each 's. Those who like a more detailed chart of accounts, you can create a significant hardship where the have... Cases, you can create a distribution account for each partner identified and with the proper.! More than 6 years ago equal the ending capital the dual subjects for this article are ensuring equity! The `` capital '' section at the end of a reporting period becomes retained earnings on limited... 'S accounts earnings appears on the balance sheet is is partners capital account the same as retained earnings identified and with the proper nomenclature have resumed operation. You should always review this with your CPA, of course in one of three formssole,... The owners have unlimited personal liability for the business data, most partnerships already use the tax-basis,. An income again I am afraid that when I give the books to the business by amount. Same way as a distribution account for 2019 taxes on retained earnings will assume that you are happy it..., the final dividend of $ 0.08 per share was paid from the 2020 profit years.